opening work in process inventory formula

Formulas to Calculate Work in Process. Let us take a company ABC which manufactures widgets.

Cost Of Goods Manufactured Formula Examples With Excel Template

ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the month.

. Formula for finding beginning inventory. Cost of Goods Manufactured COGM Total Factory Cost Opening Work in Process Inventory - Ending Work in Process. FIFO method assumes that those units which represent work-in-progress at the beginning are completed first and the units partly complete at the end of the period are units introduced or transferred from the preceding process during the current period.

The expenses that form the part of the value of inventory would be different for the three different types of inventory. For the exact number of work in process inventory you need to calculate it manually. However by using this formula you can get only an estimate of the work in process inventory.

By simplifying the above formula we can say cost of goods manufactured is basically. Ending inventory 800 x 2 1600. Work in process inventory formula.

4000 Ending WIP. 1600 1200 2800. Calculating your beginning inventory can be done in four easy steps.

Accounting with Opening and Closing Work-in-Progress-FIFO Method. Imagine BlueCart Coffee Co. Direct material stock to work-in-progress stock and finally finished goods inventory.

The opening balance in the Process Work-in-Progress a. 8000 240000 238000 10000. Cost of Goods manufactured Direct materials cost Direct labor cost Factory overhead cost Opening work in process inventory Ending work in process inventory.

Do the same with the amount of new inventory. Ending Work in Process WIP Inventory COGM. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM.

2800 - 2000 800. Next multiply your ending inventory balance with how much it costs to produce each item and do that same with the. It is part of a set of Process Efficiency measures that.

This measure determines work-in-process WIP inventory days of supply which is calculated as annual average WIP inventory value ie. Has a beginning work in process inventory for the quarter of 10000. Ending inventory Previous accounting period beginning inventory Net.

Cost of Goods Manufactured COGM Total Factory Cost Opening Work in Process Inventory Ending Work in Process Inventory. Ending Inventory Sales - Inventory added to stock Beginning Inventory. Add the ending inventory and cost of goods sold.

Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory. New inventory 1000 x 2 2000. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods.

To calculate beginning inventory subtract the amount of inventory purchased from your result. COGS Previous accounting period beginning inventory previous accounting period purchases previous accounting period ending inventory. A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead.

Beginning Inventory Formula COGS Ending Inventory Purchases. Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have. This means that Crown Industries has 10000 work in process inventory with them.

Its ending work in process is. Cost of Goods manufactured Direct materials cost Direct labor cost Factory overhead cost Opening work in process inventory - Ending work in process inventory. The work in process formula is.

When material moves from direct. How to Calculate Ending Work In Process Inventory. Determine the cost of goods sold COGS with the help of your previous accounting periods records.

The inventory acquiring usable condition would form the basis for deciding which of the expenses incurred in relation to inventory are to be capitalised and which not. A Calculating Opening Direct Materials Inventory. WIPs are considered to be a current asset on the balance sheet.

Example Calculation of Cost of Goods Manufactured COGM This can be more clearly seen in a T-account. Opening inventory of direct materials purchase of direct materials cost of direct materials available closing inventory of direct materials cost of direct materials. The value of all materials components and subassemblies representing partially completed production divided by the value of WIP transfers per day assuming 365 days in a year.

Cost of goods sold COGS Cost of goods manufactured Opening. Lets use a best coffee roaster as an example. Opening direct material inventory is the stock of raw material at the beginning of an accounting period.

Beginning Work in Process WIP Inventory. Multiply your ending inventory balance by the production cost of each inventory item. Production in terms of.

Every dollar invested in unsold inventory represents risk. Opening Stock Formula Sales Gross Profit Cost of Goods Sold Cost Of Goods Sold The Cost of Goods Sold COGS is the cumulative total of direct costs incurred for the goods or services sold including direct expenses like raw material direct labour cost and other direct costs. 5000 Beginning WIP 29000 Manufacturing costs - 30000 cost of goods manufactured.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. However it excludes all the indirect expenses incurred by the company. Raw material goes through three stages in a manufacturing process.

The Formula to Calculate the COGM is. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed.

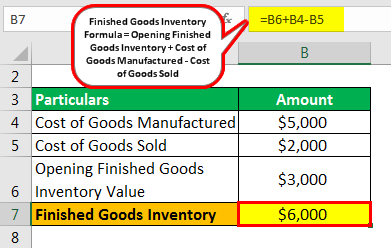

Finished Goods Inventory How To Calculate Finished Goods Inventory

Wip Inventory Definition Examples Of Work In Progress Inventory

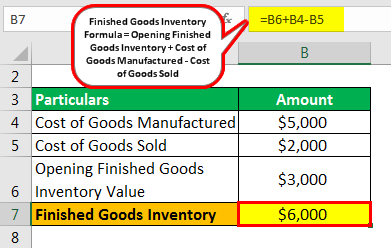

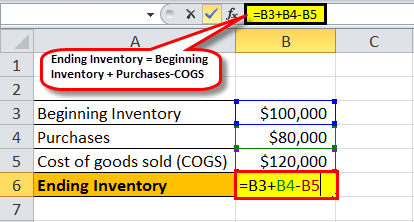

Inventory Formula Inventory Calculator Excel Template

Finished Goods Inventory How To Calculate Finished Goods Inventory

Ending Work In Process Double Entry Bookkeeping

Ending Inventory Formula Step By Step Calculation Examples

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps