philadelphia transfer tax exemption

2 Under Federal State and City laws corporations and associations are entities separate from their members. A divorced couple pursuant to the divorce decree Parent and child or the childs spouse Brother or sister or their spouse.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

The Council of the City of Philadelphia finds that.

. One of the most popular transfer tax exemptions is the intra-family exemption. You are granted an exemption. Philadelphia law currently recognizes twenty-eight exemptions in total.

Pennsylvania DOES NOT have a mortgage tax or revenue stamps. While this tax adds an extra expense to transferring property there are a number of transfer tax exemptions available which may allow you to avoid paying the tax. Philadelphia transfer tax law excludes 28 transactions while Pennsylvania transfer tax law excludes 34 transactions.

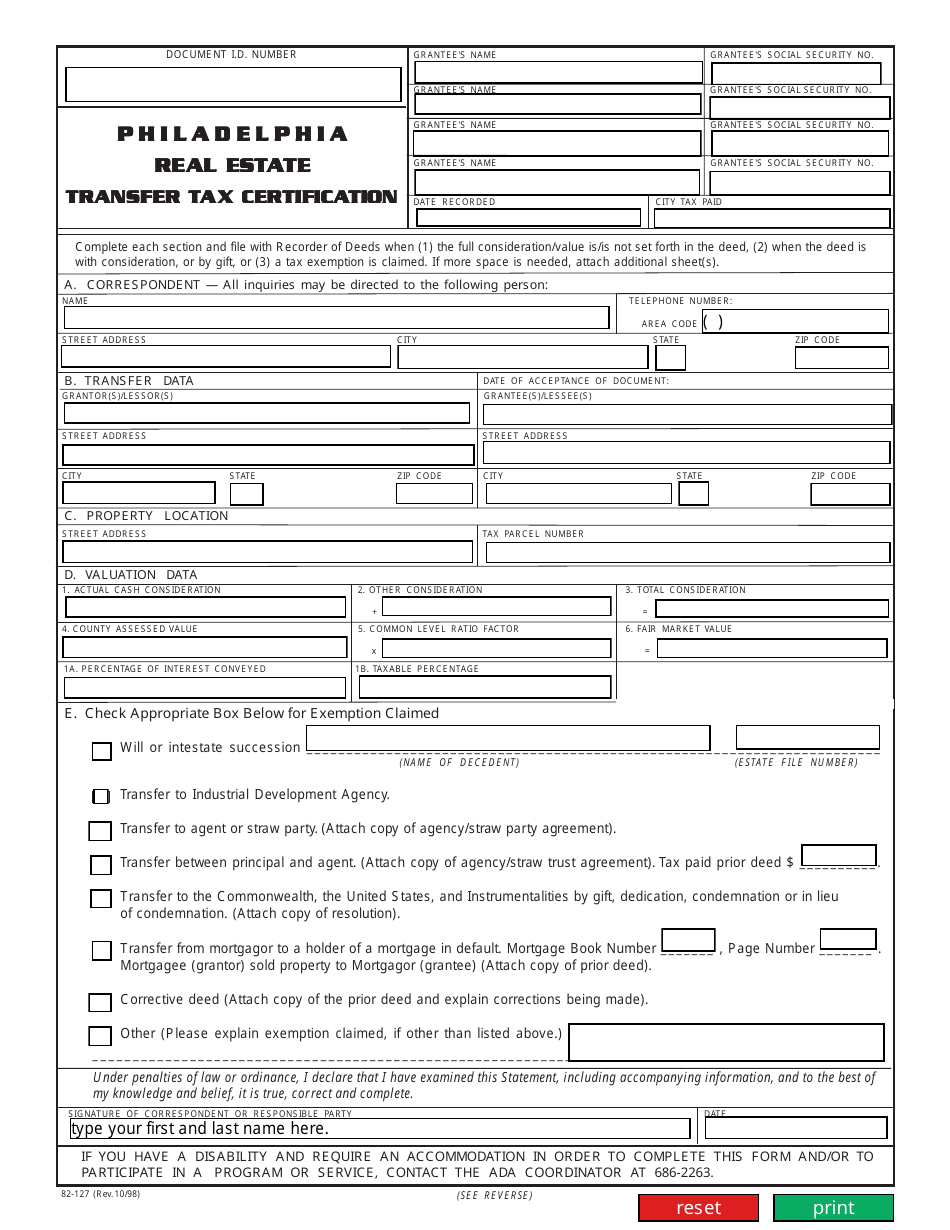

Philadelphia real estate transfer tax certification complete each section and fi le in duplicate with recorder of deeds when 1 the full considerationvalue isis not set forth in the deed 2 when the deed is with consideration or by gift or 3 a tax exemption is claimed. Transfer to or from the agents principal by the third party would be exempt from tax. For 2022 the increased transfer tax exemptions are as follows.

The transfer tax in Philadelphia is 3 and on transfers for nominal consideration the tax is based upon the Fair Market Value of the property. When we say exemption what we mean is there are certain times when recording the transfer of a property from one party to another does NOT trigger the need to pay either the city or the county transfer tax. The following transfers are excluded from the tax.

The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia. 24 A transfer to or from non-profit housing corporations incorporated by officials of the City for the purpose of promoting the development of low cost housing in the City of Philadelphia however if the transfer is from such a corporation to a for profit grantee or to a person who does not qualify as a low to moderate income person as defined by the Housing and Community. Additionally a transfer to or from a nonprofit housing corporation that has been incorporated by officials of Philadelphia for the purpose of promoting the development of low cost housing in the city is exempt from the tax.

PdfFiller allows users to edit sign fill and share all type of documents online. Philadelphia transfer tax exemption. Long-term leases 30 or more years Easements.

Ad Register and Subscribe Now to work on DoJ App for Tax Exempt Transfer and Reg of Firearm. Both Pennsylvania and Philadelphia transfer tax law excludes the federal state or local government or its agencies from tax for all transactions. The tax is prorated in accordance with the percentage of interest being transferred.

These documents contain the full regulations for the Realty Transfer Tax as well as clarifications from technical staff on how the Department of Revenue interprets the law. The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax. Attach a copy of the agencystraw party agreement and a statement explaining the exemption claimed.

Some real estate transfers are exempt from realty transfer tax including certain transfers among family members to governmental units between religious organizations to shareholders or partners and to or from nonprofit industrial development agencies. This link will take you to a sales tax table with an 800. Complete the correct certificate and submit it when you record the deed or mail in your realty.

While the majority of realty transfer tax is deposited into Pennsylvanias General Fund 15 percent of collections are dedicated to the Keystone Recreation Park and Conservation Fund. This property is exempt from any relevant local or special taxations. To take advantage of this exemption the transfer cannot be to a for-profit grantee or to a person who does not qualify as a low to moderate income person.

Excluded parties and transactions. One of the most popular transfer tax exemptions is the intra-family. First a quick refresher there is a 2 transfer tax on real estate transfers in most municipalities across pennsylvania with 1 going to the state and 1 to the local governmentthe pa transfer tax rate is higher in a handful of towns such as the city of.

The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia. One of the most popular transfer tax exemptions is the intra. Eration to a trust is exempt from tax when the transfer of the same property would be exempt from tax if the transfer.

Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes across on the day-to. How is Philadelphia transfer tax calculated. Common transactions that are excluded from real estate transfer tax include.

Husband and wife. While this tax adds an extra expense to transferring property there are a number of transfer tax exemptions available which may allow you to avoid paying the tax. The following transfers are excluded from the tax.

Philadelphia Code 19-1405 6 exempts transfers between. Below are a few of the more notable exemptions. The philadelphia tax abatement has been a hot topic of debate in recent news and its increasing publicity has made it increasingly relevant for prospective buyers and current residents of philadelphia.

However if the party to whom the property is being transferred is not an excluded party that party may in fact be responsible for the transfer tax if the transaction itself is not excluded. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now. This exemption also applies to adding a Financially Interdependent Person to your Deed.

The tax becomes payable when a property deed or other document showing realty ownership is filed with the Records Department. Below are a few of the more notable exemptions. Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax.

Documents showing ownership include. Transfers to an excluded party by gift or dedication confirmation deeds correctional deeds transfers between certain relatives transfers between certain non. 1 There are business economic and tax reasons for entities holding real estate to do business as corporations or associations.

Philadelphia law currently recognizes twenty-eight exemptions in total. 3278 city 1 commonwealth 4278 total the tax rate is based on the sale price or assessed value of the property plus any assumed debt. 266 to a delaware limited partnership the transaction will give rise to philadelphia realty transfer tax.

Transfer Between Principal and Agent - A transfer between an agent or principal for no or nominal consideration is exempt. These exemptions are outlined in The Pennsylvania Code Section 91193 entitled Excluded Transactions.

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Philadelphia Transfer Tax Form Fill Online Printable Fillable Blank Pdffiller

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Estate Tax Exemption Will Fall Now Is The Time To Plan Rea Cpa

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Tax Season 2022 How To File Correctly Your Taxes And Get Your Refunds Faster Marca

Real Estate Transfer Tax Montgomery County Local Law Firm

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Philly Taxes Employer W 2 Submission Simplified Department Of Revenue City Of Philadelphia

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp